iStock / bestgreenscreen

Last month, in a petition formally filed with the United States Department of Agriculture (USDA), two advocacy groups made a stunning claim: Your American grass-fed beef might actually come from overseas, even if it’s labeled “Product of U.S.A.”

This story received an honorable mention in the 2018 Society for Advancing Business and Editing and Writing Awards (retail category).

Those two groups—the American Grassfed Association (AGA), which offers the country’s leading “grass-fed” certification, and the Organization for Competitive Markets, a watchdog group that fights corporate consolidation in the food industry—point out that a massive regulatory loophole allows companies to falsely, and yet legally, claim their imported beef comes from our pastures.

The trouble began in 2015, when the Obama administration’s USDA rolled back Country of Origin Labeling (COOL) for beef and pork products, allowing meat to be sold without disclosing its home country on the label. But that decision, which angered many American ranchers, has further muddied the waters in a way no one quite anticipated. Under the current rules, beef and pork products that are shipped to the United States and processed further here, can be labeled “product of U.S.A.,” even if the animal was raised a continent away. That means a steer slaughtered in Uruguay and broken down into steaks at a meatpacking plant in Colorado is technically American meat—even if it isn’t.

That’s a huge issue for American grass-fed producers, who are now finding themselves undercut by foreign competition. Allen Williams, a 6th-generation rancher and founding partner of Grass Fed Insights, a leading consulting group on grass-fed beef, says U.S. producers owned more than 60 percent of the domestic grass-fed market in 2014. Then came COOL repeal. By 2017, American ranchers’ share had plunged to just 20 to 25 percent, according to an industry analysis by the Stone Barns Center for Agriculture. Today, Williams, who consulted on the Stone Barns report, says American producers claim only about 15 percent of the grass-fed market—and that share is rapidly shrinking.

Imported grass-fed beef brands are taking advantage of a legal ambiguity—and some are downright deceptive.

Ranchers attribute the decline directly to COOL repeal. The fact that foreign companies can pass their imported beef off as American, they say, has made fair competition impossible.

“The very idea of labeling beef in a grocery store ‘product of U.S.A.,’ when the animal never drew a breath of air on this continent, is just horrible,” says Will Harris, owner of White Oak Pastures, which produces its branded line of grass-fed beef in Bluffton, Georgia. (Harris is also on AGA’s board of directors.) “I don’t begrudge importers or producers from other countries selling to knowing consumers that want to buy that imported product. But I’m appalled at what the deception has done to the economies of our membership. It has moved the needle from grass-fed beef producers being profitable, to being a very break-even—or, if you’re not careful, a losing—proposition.”

“The very idea of labeling beef ‘product of U.S.A.,’ when the animal never drew a breath of air on this continent, is just horrible.”

But though pastured beef often isn’t as American as it looks, a question remains: How much does it actually matter? I found myself wondering how much we mean to prioritize domestic purchasing when we spend a little more to buy grass-fed, and whether the product’s country of origin makes a meaningful difference. Are grass-fed steaks from Australia all that different from those raised on a ranch outside Austin, Texas? I wanted to know whether we we should stop handwringing about geography—or if misleading labels somehow betray the grass-fed ethos, and amount to a profound abuse of consumer trust.

Grazed and confused

If Williams is right that only 15 percent of the grass-fed beef is raised domestically, you wouldn’t necessarily know it just by strolling through the grocery store. On a recent trip to Trader Joe’s, I inspected a package of “100 percent grass-fed organic ground beef,” looking for clues about its origins. The casual observer could be forgiven for mistaking that product for American meat. The splashy consumer-facing label features a USDA organic seal, a USDA inspection sticker, and, in smaller print, the phrase “processed in USA” alongside Trader Joe’s corporate address in Monrovia, California. Of course, foreign beef can still be certified USDA organic and all imported meat goes through USDA inspection. But this product features not one but four allusions to the U.S. on its label. The average shopper wouldn’t be crazy to assume it’s coming from here.

Flip the package over, though—to the side few people read up close—and the label tells a different story. In small, no-frills font, below the freeze-by date and above the safe handling instructions, are the words “Product of USA, Australia, and Uruguay.” That phrasing would seem to suggest that Trader Joe’s ground beef is a blend of beef from American, Australian, and Uruguayan cows—an arrangement that might surprise some customers, given what the front of the package says. But even that reasonable assumption may not be accurate. Trader Joe’s may only be buying Australian and Uruguayan meat that’s then ground at a facility in the U.S.—enough to qualify as American in the eyes of regulators. It isn’t really possible to tell.

If Trader Joe’s and other grocery brands were really selling meat from cows raised in this country, you’d think they’d make a bigger deal of it.

Joe Fassler

Trader Joe’s organic grass-fed ribeye steak also prominently features USDA’s organic and inspection seals on the front—as well as the phrase “Product of USA” in small font on the back, by the nutrition facts. But are the company’s grass-fed ribeyes really produced here? Or are they just processed here? It’s impossible to tell from the label alone, and Trader Joe’s had not responded to my requests for clarification by press time.

The Trader Joe’s scenario is a good example of how products can follow the letter of the labeling law and still be misleading. But other brands have done more to take advantage of this legal ambiguity—and some are downright deceptive.

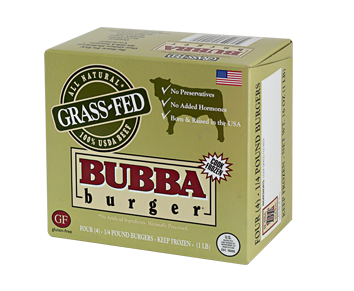

Bubba Foods, a Jacksonville, Florida-based company whose products are sold by major retailers like Walmart, Kroger, and Wegman’s, puts its American-made claims front and center. The label on the company’s grass-fed ground beef displays a prominent “Product of USA” banner, complete with an American flag—and, if that wasn’t enough, the proud phrase “Born & Raised in the USA.” But paperwork filed with USDA, obtained by the American Grassfed Association and shared with me, suggests the product may not be American at all—at least, not in the conventional sense most shoppers would understand.

Bubba Burger

Bubba Foods’ marketing would suggest that its beef is born and raised in the U.S. A look at its affidavit to the USDA suggests otherwise.

Any producer who wants to sell a commercial grass-fed beef product has to file an affidavit with USDA’s Food Standards Inspection Service (FSIS), laying out the agricultural practices it will use and submitting an example of their product label. Bubba’s affidavit includes several details that caught my attention, considering the aggressive nationalism of its label. A nutritional analysis describes the product as “import grass-fed” beef. It also includes an import record from Australia, noting that an “Australian National Vendor Declaration” will certify the product’s grass-feeding regime. The final 20 pages of the document lay out the specifics of Australia’s Pasture-Fed Cattle Assurance Standard, a program that isn’t available in other countries.

Bubba Foods initially assured me the company would answer my questions about the discrepancy, but did not provide more information after multiple follow-ups. At this point, the opacity only furthers my suspicion that the company is passing off its Australian grass-fed beef as a “born and raised” U.S. product—with the U.S. government’s blessing. (Bubba’s affidavit also contains a copy of its product label, which regulators presumably viewed in all its chest-thumping patriotism.) No wonder eaters are confused.

By now, it should be obvious that misleading—and, in some cases, overtly deceptive—labels are out there. But we still haven’t established whether any of this is a meaningful deception, materially speaking. Does anyone really care if their grass-fed beef comes from America or Australia—and, if not, should they?

Eating American

In his work as a consultant, Allen Williams and his clients have spent millions of dollars trying to pin down exactly what compels shoppers to buy grass-fed beef. His findings suggest that (relative) locality is a huge selling point: A desire to support America’s rural economies is one major reason people spend more to buy grass-fed. The preference is so clear that Williams believes virtually all of the products with fine-print “Product of USA” claims are really imported. If Trader Joe’s and other grocery brands were really making the effort to buy meat from cows raised in this country, you’d think they’d make a much bigger deal of it.

If someone wants to help the environment, they’re likely to want to do so in their own backyard first.

Charlie Bradbury runs Grass Run Farms, an American-raised, grass-fed beef brand owned by JBS, the world’s largest multinational meatpacker. He tells me that JBS—which has long sold grass-fed products from Australia and elsewhere, and marketed them as such—acquired Grass Run Farms because so many customers asked for specifically domestic grass-fed beef.

“The fact that the cattle are born and processed in the U.S. is an important reason people buy this product,” he says. “These cattle generally do come from smaller, family-farm operations. They [shoppers] believe the animal welfare is improved [in that context] and so, since our job is to sell beef, we’re trying to produce a system that fits in with those concepts.”

Will Harris offers some insight into why demand for American grass-fed is so strong. Over the years, he’s learned that customers buy White Oaks beef for three primary reasons: environmental sustainability, animal welfare, and to support rural economies, in that order. (Health considerations are a factor, too, but not in the top three.)

“The real environmental impacts of grass-fed beef products have much more to do with how they are produced than where they’re shipped from.” — Caitlin Peterson, PhD student in ecology at the University of California, Davis

Each of these main drivers has a strong local emphasis, he tells me. If someone wants to help improve the environment, they’re likely to want to do so in their own backyard first. Those worried about animal welfare are more likely to feel assured by local products, with a farmer they know by name and a ranch they can visit, than by a product from a continent away. Finally, anyone buying grass-fed to support the local farm economy is certainly going to privilege domestic product. In Harris’s view, it couldn’t be any clearer—when buying grass-fed, Americans explicitly prefer that it be American.

But say you’re the kind of ethically minded meat eater who just wants to do what’s best for the planet in general. Does it really matter whether your burger comes from your local farmers’ market versus a ranch in Australia or Uruguay?

That’s harder to say.

“If we are comfortable with the assumption that grass-fed beef is indeed more environmentally friendly than CAFO beef—and this depends quite a bit on your method for calculating environmental costs—then the real environmental impacts of grass-fed beef products have much more to do with how they are produced than where they are shipped from,” Caitlin Peterson, a PhD student in ecology at the University of California, Davis, told me by email. That’s because shipping beef across the ocean in a storage container is an incredibly cheap and efficient transportation method that doesn’t require much energy use or generate much pollution, even if it does rack up so-called “food miles.” Agricultural methods, she says, matter far more in general than transportation distances.

The trouble is that it’s very hard to get information about a given grass-fed producer’s practices. No government I could find legally defines a “grass-fed” standard. (The U.S. did, beginning in 2007—but ultimately revoked its standard in 2016, citing USDA’s inability to properly enforce it.) Though a few respected third-party certifications exist—the American Grassfed Association’s “Certified Grassfed” label is considered the gold standard by producers—ranchers can claim their product is grass-fed without independent verification. To use the term on products sold in the U.S., meat companies must only file an affidavit with USDA explaining how their grass-feeding program will operate. They can use an existing certification, or define their own protocols. As a result, practices vary widely, and quality control is difficult.

Imported grass-fed beef is not a better product, necessarily. It’s simply cheaper.

“Grass-fed is all over the map,” says Rick Machen, a professor and livestock specialist with Texas A&M University. “It could be a 700-pound calf right off the cow up to a 14-year-old cow that’s lived out its productive life. And within those there’s all kinds—some are supplemented, some are 100-percent grass-finished. There’s a wide, wide, wide array of pre-harvest production systems, and technically they’re all within the bounds of what can technically qualify as grass-fed.”

Considering that, it’s hard to compare the environmental impact of domestic versus imported grass-fed beef in general. But if sustainability concerns are a wash, domestic product really does fare better by one all-important metric: economics.

The price of grass

There’s a reason that imported grass-fed beef has come to dominate the American marketplace. It’s not because it’s a better product, necessarily. It’s simply cheaper.

Take Australia, for instance—the country that by far exports the most grass-fed beef to the U.S.—where virtually all beef production is pasture-based. Since cattle can graze year-round on the country’s naturally lush pastures, it makes far less sense to fatten them on grain. That makes the cost of bringing a steer to weight a much cheaper proposition—especially compares to many regions of the U.S., where grassland must be irrigated, or where cattle must be fed dried forage during the winter.

“You’re working on razor-thin margins and any little economic hit can take you out of the game.”

Though severe drought in Australia has complicated this picture in recent years, bringing the price of imported grass-fed beef closer to its domestic competition, the country has built-in advantages that have allowed it to undercut U.S. producers on price.

But Australia has an additional, and perhaps more signficant, advantage. Grass finishing has been the standard for so long that it’s big business, and has been for decades. Cargill and JBS, two of the biggest meatpackers in the world, process a combined 49 percent of the country’s grass-fed beef.

A company like Greeley, Colorado-based JBS, which owns farms, slaughterhouses, and transportation infrastructure on multiple continents, and has accounts with major retailers and foodservice providers, benefits from economies of scale unheard of in U.S. grass-fed beef production. In the U.S., where grass-fed claims just 1.5 percent of the overall market, it’s mostly small producers working with small, independent processors and marketing their products themselves. More than half of America’s grass-fed producers sell twenty or fewer cattle a year, according to the Stone Barns report, and most of them are too small to access the country’s hyperproductive slaughterhouses.

This distinction marks perhaps the fundamental difference between U.S. and imported grass-fed beef. In America, grass-based production is an alternative vision supported by individual innovators and rooted in local economies. In Australia, New Zealand, Uruguay, and other countries, it’s an established industry controlled by powerful global players.

“It’s a commodity product,” says Williams, speaking of imported grass-fed beef. “It’s produced off many different ranches, then harvested by the big packers. They’re the same guys that are the big packers over here in the U.S. It’s all aggregated together and shipped over here.”

If Americans are buying grass-fed as a way to support local foodways and bring dollars back to rural communities—and many of them seem to want to—that’s not happening when they’re fooled into buying imported beef.

For U.S. ranchers, switching to grass-fed can completely transform the economics of production. Williams says that the average American cattle rancher, someone who sells live animals to the big meatpackers churning out commodity beef, makes only about 14 cents of the retail dollar. “That way,” he tells me, “you’re working on razor-thin margins and any little economic hit can take you out of the game.”

Grass-fed beef producers selling directly to their customers can keep up to 85 percent of the retail dollar.

gerenme / iStock

But grass-fed producers selling directly via farmers’ markets can keep up to 85 percent of the retail dollar, according to Williams. And ranchers who run branded programs—paying a smaller, custom packer to process their animals, then selling that signature line of beef with the help of various retail partners—can reach thousands of customers while still keeping 25 to 50 percent of the retail dollar.

There are challenges, of course. Greenmarkets are a low-volume business—it’s hard to reach that many customers, even if the margins are signficantly higher. And branded programs are a more expensive way to do business, with added costs related to marketing, distribution, and slaughter. Still, the margins improve enough to double or triple the income earned on every animal—giving ranchers a chance to make up for the increased costs of grass-fed production, mitigate their risk, and earn a sustainable living.

But now that the market’s been flooded with cheap imports, America’s grass-based ranchers aren’t thriving the way they’d hoped to. Though retail sales of grass-fed beef have soared—from $17 million in 2012 to more than 16 times that, $272 million, in 2016—American ranchers aren’t the ones reaping the benefit of all that increased demand. Harris and other ranchers attribute this directly to consumer confusion over labels. If we can’t tell the difference between Australian and American grass-fed beef—if both are labeled “Product of USA”—even a locally minded shopper is more likely to go with the cheaper product. The result, for ranchers who have spent heavily to transition or grow their herds, may be economic devastation.

If the U.S. took back only 50 percent of the market, it would send hundreds of millions of dollars into local communities each year.

Let’s go back to the petition that the American Grassfed Association filed with USDA for a moment. The organization believes that, if labeling law can be changed, ensuring that only truly American-raised beef is labeled that way, shoppers will start buying domestic grass-fed again, even if it costs more. If the choice between domestic and imported is made more apparent, grass-fed proponents like Carrie Balkcom and Will Harris think American grass-fed beef will have a fightning chance—that our rural communities will finally see the economic benefits of the standard they helped to build.

The fact that USDA is taking public coments on the issue suggests that the agency may be reconsidering things. And that could be a sign that significant change is on the horizon.

“As a U.S. grass-fed beef producer, I believe it is imperative that honest, transparent labeling is required for grass-fed beef sold in America,” writes Kay Allen, a Texas rancher, one of many producers who has commented publicly on the petition. “Not only does honest labeling protect American beef producers economically, it insures that WE, American citizens, control our own food supply.”

For those who want to see rural economies revitalized, the stakes are high. Labeled grass-fed beef is only about a $1 billion market in the U.S., tiny compared to the nation’s $105-billion conventional beef industry. But Williams points out that if the U.S. producers took back only 50 percent of the market—still down from more than 60 percent market share they enjoyed in 2014—it could send hundreds of millions of dollars into local communities each year. That would be a major departure from the current system, where profits from grain-finished domestic and grass-fed imported cattle flow primarily to large corporations.

“Instead of requiring just a handful of mega feedlots to finish all this beef, we would need tens of thousands, even hundreds of thousands of smaller farmers and ranchers,” Williams says. “So instead of having one mega business, one major corporation, we’d be allowing thousands of small businesses, vibrant small businesses, to thrive. It would be a major boon not just to ranchers, but to local processors, and cold storage, and everyone who has a finger in this pie. Why would we not want to do that?”

The USDA is currently asking itself that same question. The agency will take public comments until August 17.