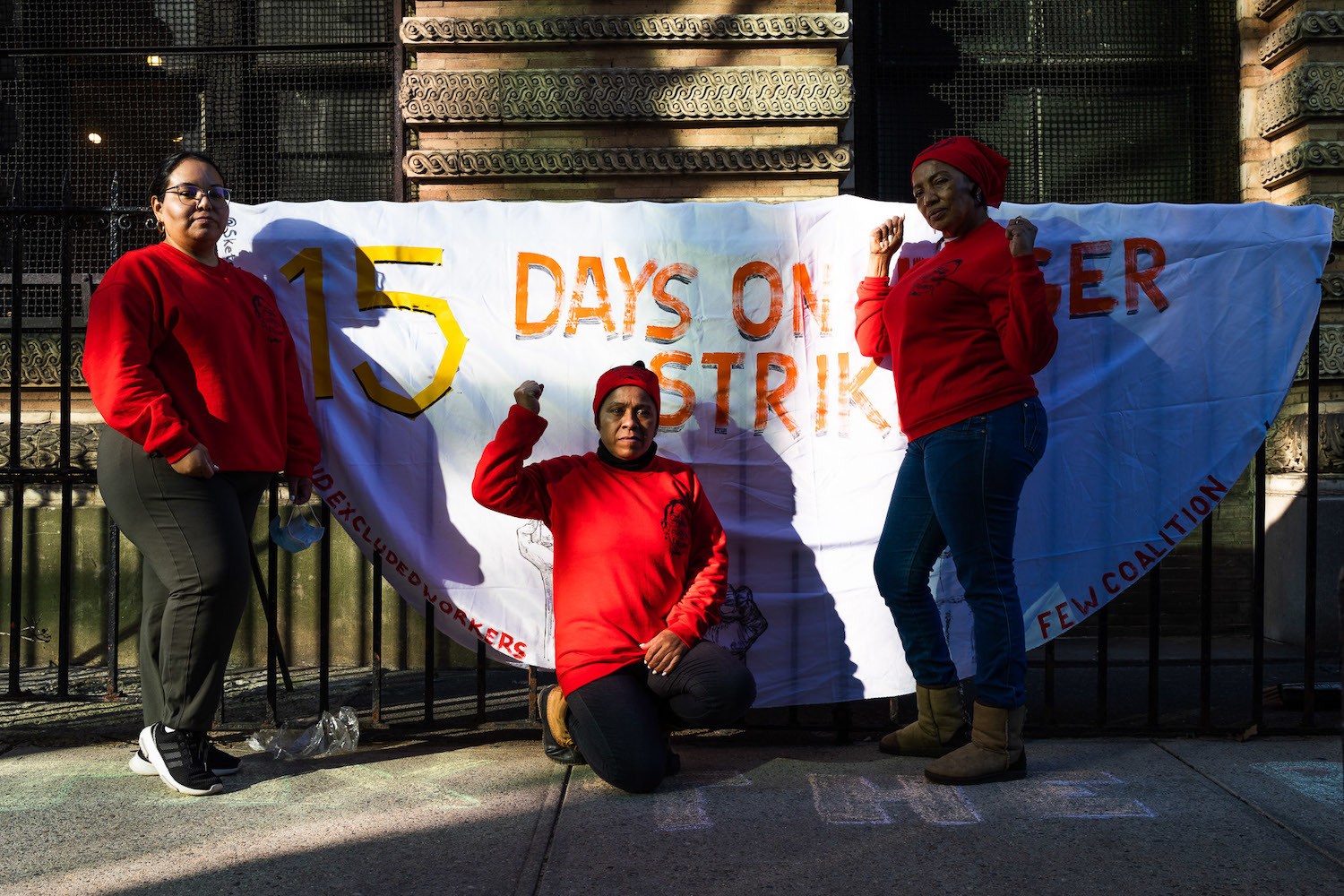

Spencer Platt/Getty Images

In late May, the Small Business Administration stopped processing relief applications from women, veterans, and people of color. Then the agency started rescinding their approvals.

When Kazu Fukumoto, the owner of a Japanese restaurant in Austin, Texas, got word that he had been approved for a Restaurant Revitalization Fund (RRF) grant in late May, it felt like a weight had been lifted off his shoulders.

The pandemic had taken his namesake company Fukumoto right to the edge of insolvency. At first, Fukumoto had to shut down operations completely. A few months in, he launched takeout and delivery options, but that revenue couldn’t fully cover the cost of staying afloat. Fukumoto said he had to dip into savings to make up the difference.

Courtesy of Kazu Fukumoto

Kazu Fukumoto, the owner of a Japanese restaurant in Austin, Texas. Fukumoto got word he’d been approved for a Restaurant Revitalization Fund grant in late May. However, by June, he found out SBA wouldn’t pay out the promised reward.

Fukumoto applied for an RRF grant worth over $200,000 the day that the application portal opened, and on May 28, he received an email notifying him that his request had been approved. Money from the fund, as its name implies, would help Fukumoto reopen at full capacity, by enabling the restaurant to hire back lost staff, repair appliances, and pay off lingering debts.

“When I saw that, I was like, ‘Oh my god, this will help so much,’” he said. “Finally I could make this restaurant much better, we could hire more people, we could pay off our debts …. We could get back to where we were before.”

But what had first appeared as a lifeline soon sent Fukumoto into a tailspin. On June 12, the restaurant received another email from the Small Business Administration (SBA)—the agency overseeing the fund—this time stating that it would not be able to pay out the promised award. (The Counter reviewed the email). Recent litigation filed by conservative groups alleging discrimination against white men had forced SBA to stop processing applications from priority groups, including women, veterans, and minorities, the agency explained.

Since then, SBA has continued to rescind promises made to priority applicants. On June 23, it sent out another email to an unspecified number of recipients saying that it would have to cancel their grants due to the lawsuits. But one business owner who received this notice (who requested that her identity be withheld) had previously been approved for relief on May 20—well before any of the legal challenges had taken effect—according to emails reviewed by The Counter.

“Finally I could make this restaurant much better, we could hire more people, we could pay off our debts …. We could get back to where we were before.”

Because he identified as Asian-American on his application, Fukumoto fell into a group whose relief requests were now in jeopardy.

When Fukumoto first saw the email, “I was very confused at first,” he said. “And then I got really angry.”

At this point, the RRF is close to running out of money. For restaurants that are still waiting for money to get into their bank accounts, their chances of seeing any relief at all are dwindling by the day. The Counter reached out to restaurateurs across the country who haven’t yet received aid to better understand how they are making sense of the program’s rocky rollout—and how optimistic they are in the face of ongoing financial uncertainty.

At first, Fukumoto shut down operations completely and a few months in he launched takeout and delivery options, but that revenue couldn’t fully cover the cost of staying afloat.

Courtesy of Kazu Fukumoto

Congress created the RRF in March and funded it to the tune of $28.6 billion. In the early weeks of its implementation, it faced multiple lawsuits from conservative groups challenging the constitutionality of the three-week preference period it designated for women, veterans, and minorities. In late May, this litigation led SBA to make a significant procedural change: It would only process applications filed by white men for the foreseeable future. Per the agency, nearly 3,000 restaurants have been caught in an unexpected crossfire due to the litigation: approved for relief but denied a payout.

This number doesn’t fully capture all the restaurants that are feeling left behind by the program. Many more are still waiting for SBA to reach any kind of decision—be it approval or rejection—regarding their application. According to an SBA spokesperson, there remains about $1 billion in the fund as of late last week.

The people we interviewed expressed fear and anger that their place in the priority category had been weaponized against them. Many are simply pleading for SBA to provide transparency on their pending applications. One restaurant owner never even bothered to apply, resigned that the money would run out before his application could be considered. All were unified in one respect: They’re holding out hope that Congress will replenish the program’s funding, so that they might have another shot at recovering the crippling losses they’ve incurred.

The advocate who helped make restaurant relief a reality

It wasn’t until the American Rescue Plan became law that Amanda Cohen—chef and owner of the storied, vegetable-focused restaurant Dirt Candy in New York City—got her first good night of sleep since the pandemic started, she said.

Courtesy of Amanda Cohen

For a year, Amanda Cohen had been lobbying lawmakers for industry-tailored relief as part of her work with the Independent Restaurant Coalition (IRC).

For a year, Cohen had been lobbying lawmakers for industry-tailored relief as part of her work with the Independent Restaurant Coalition (IRC), a group she co-founded after Covid-19 leveled the hospitality industry. The pandemic had plunged many restaurants into debt, and that financial burden can hamstring recovery: Restaurant owners told The Counter that debt poses a barrier to paying competitive wages, fixing broken equipment, and even buying ingredients.

The RRF, as passed, very closely resembled the legislation that IRC had supported: Aid would be limited to smaller restaurants—not national chains—and would include built-in provisions to avoid the shortcomings of other Covid-19 relief programs. (In the case of the Paycheck Protection Program, for example, women and minority applicants were found to be underserved due to a disproportionate lack of access to capital.)

That’s why it may seem like a particularly cruel twist of fate that Cohen’s own relief application was denied due to her being a woman.

Cohen said that she applied for relief within hours of the program portal’s opening on May 3. For the first few weeks, she opted to tune out chatter about the lawsuits accusing SBA of discrimination.

“[The threat] just didn’t seem real,” Cohen said. “Everybody told us not to worry, that this happens. And then obviously it became very real.”

On June 11, Cohen got a notice from the agency saying that her application would not get approved unless Congress replenished the RRF. The news “devastated” Cohen, who had banked on the idea that her request would be considered no matter what, based on how early it was submitted.

“It actually feels like a punishment right now to be in the priority group,” she said. Cohen estimates that Dirt Candy’s revenue fell by about 75 percent in 2020, compared to the year prior, and doesn’t expect it to return to pre-pandemic levels until the tourism industry is revived. On the other hand, she said she’s less concerned about herself than she is for the industry as a whole.

The dining room of Dirt Candy, a vegetable-focused restaurant in New York City where Cohen is the chef and owner.

Courtesy of Dirt Candy

“Dirt Candy will be fine, we will not close because we didn’t get the money,” Cohen said. “It’ll make for a couple more difficult years, but we’re 13 years old and we have good standing. I really feel much worse for the restaurants that are on the edge.”

The restaurateurs who applied on day one—and never heard back

Other restaurant owners feel like they’ve been stuck in a different kind of agony: suspended for weeks in the purgatory of a “pending” application.

Antwan Smalls, chef and co-owner of My Three Sons of Charleston, a South Carolina restaurant that serves Southern and Gullah cuisine, said that he’s been waiting for SBA to issue a decision on his case for more than a month. Smalls told The Counter that he filed for aid on the day the RRF portal opened, self-identifying as an African-American and a veteran (two priority categories). His mother, a co-owner of the business, is an African-American woman and veteran, as well.

Like Fukumoto, Smalls relied on savings to buttress his business over the course of the pandemic. He was optimistic about the RRF program early on, but found his hopes largely dashed over the past six weeks.

“Everybody told us not to worry, that this happens. And then obviously it became very real.”

“When they told me what [RRF] would entail, I got excited thinking I would finally receive some relief after a year of trying to figure out how to keep the lights on,” he said. “Now, I’m back to square one.”

The program was relatively simple: Applicants submitted their business records for 2019 and 2020—presumably there’d be a significant decrease in revenue—and RRF would fund the difference. Smalls said that he had applied for a grant worth approximately $50,000.

He had hoped to apply this money towards rent and equipment repairs that were delayed last year. Without the grant, he expects recovery to come at a much slower pace. For example, even though My Three Sons is open, the restaurant is still not operating at full capacity yet, out of an abundance of caution. (There are no restrictions or capacity limits on indoor dining in South Carolina.)

“We want to be smart about it, we want to be safe about it, because we know not everybody is fully vaccinated,” he said.

“It actually feels like a punishment right now to be in the priority group.”

Likewise, in Louisiana, chef and restaurateur Nina Compton is continuing to space tables at her restaurants six feet apart, a measure that maximizes safety but hampers revenue. Compton also applied for an RRF grant on the day the portal opened, anticipating it could help her jump-start the business. It’s still pending.

Compton stressed that relief would not just benefit her businesses—Compère Lapin and Bywater American Bistro—it could lead to beneficial ripple effects along the entire restaurant supply chain.

“People think it’s just about the restaurant, but that trickles down to the linen company, to the wine company, to the produce farmer, to the fishermen. If restaurants are not thriving and busy, those guys are affected as well.

“If I was able to get those funds, it would change the game completely,” she added. “I’d be able to run my business in a smooth and consistent manner that can also support my staff, support my purveyors, and also support the city that I live in.”

The plaintiff behind an early discrimination lawsuit who said he never meant to hurt anyone

Courtesy of Phil Greer

Greer Ranch Café in Stephenville, Texas.

Phil Greer, a white man and the owner of Greer Ranch Café in Stephenville, Texas, was one of the first people to sue SBA over the relief fund distribution. He told The Counter that he has some regrets about how things turned out.

“From the very beginning, I certainly didn’t want to have anybody not receive [relief] or not be in line or anything like that,” he said.

On May 13, represented by America First Legal, Greer filed a lawsuit against SBA aimed at eliminating priority RRF categories. Greer told The Counter that he was referred to the group by local elected officials who patronized the restaurant. There was just one catch: Greer never actually filed an application of his own. In fact, just six days after filing the lawsuit, he canceled his own case.

Greer said he pulled out because there were other restaurants who were more than willing to take up the cause. Indeed, America First Legal almost immediately filed another lawsuit with new plaintiffs.

Greer said that he never ended up filing an RRF application because he thought that the money would run out before his restaurant would get any consideration. That doesn’t exactly track: The federal judge overseeing his case had directed Greer to apply, and ordered SBA to process it as if the application had been filed on May 3, according to court documents. Greer was unclear about why he didn’t follow through, and instead opted to bow out of the lawsuits altogether.

In any case, he claimed he was dismayed by the effect that ongoing discrimination lawsuits ended up having on restaurants owned by women, veterans, and minorities.

On May 13, Phil Greer filed a lawsuit against SBA aimed at eliminating priority RRF categories.

“My intention was not to make other categories suffer,” he said, referring to priority groups. “I didn’t intend for anyone to stop receiving funds. The goal was not to do harm.” His only motivation, he said, was his belief that money be handed out on a strictly first-come, first-served basis.

Greer stressed that he empathized with the challenges all of his industry peers are facing right now. His own cafe is struggling to hire and retain staff, and it lost $100,000 in revenue in 2020, according to his lawsuit. If Congress were to eventually replenish the restaurant relief fund? Greer said he would “absolutely” apply.

—

Just how feasible it is for Congress to replenish the RRF remains unclear, though proposals to do so have gained bipartisan backing in the past two weeks. Earlier this month, Rep. Earl Blumenauer (D-OR) introduced a House bill that would add $60 billion to the bucket; a companion bill was also introduced in the Senate.

That’s more than double what the American Rescue Plan allocated to the RRF the first time around—and it still might not be enough. The IRC has previously estimated that at least $120 billion is needed to guarantee the recovery of independent businesses.

“It’s not even a drop in the bucket when you think of how many people are impacted,” said Compton, referring to the RRF’s initial allocation.

“I had made a plan, I had imagined a future. All my plans and dreams shut down right there.”

Online, restaurant owners are airing their grievances with SBA and finding solidarity with those in the same bind. A sub-Reddit dedicated to the program (abbreviated “sbarrf”) has grown to almost 2,000 members, who encourage one another daily to call and write legislators demanding more relief. Occasionally, there have also been flare-ups of tension, as members debate the merits of the priority system.

Some, like Cohen, believe that the multiple lawsuits aimed at disrupting the RRF rollout represent resources that could have been better spent advocating for more money on behalf of all restaurants. Others, like Fukumoto, lament the priority group system, resenting the way that it backfired on the very groups that it had intended to benefit.

When we spoke last week, he said that his primary challenge right now was hiring the necessary chefs and personnel to fully reopen. What had been on the cusp of possibility after his RRF application was approved now appeared to be slipping out of reach—for reasons beyond his control.

“I had made a plan, I had imagined a future,” he said. “All my plans and dreams shut down right there.”