Darrell Hoemann/C-U Citizen Access

An Investigate Midwest investigation shows Shahid Khan has snapped up 24,000 acres in recent years, but is staying mum about his next steps.

This story was co-published by CU-CitizenAccess.

Illinois billionaire Shahid Khan is known for building the automotive parts company Flex ‘N Gate, based in Urbana, IL, into a global manufacturer with 69 facilities around the world.

This article is republished from The Midwest Center for Investigative Reporting. Read the original article here.

He also is known as the owner of the National Football League team Jacksonville Jaguars and the UK’s Fulham F.C. soccer team.

In addition, he has given millions of dollars to his alma mater, the University of Illinois at Urbana-Champaign, and millions to other charitable causes.

In recent years, he has added to investments by quietly purchasing farmland through a company he owns called Baloo Enterprises LLC. A spokesperson for Khan confirmed earlier this month that Khan has purchased roughly 24,000 acres of farmland in central Illinois.

“What’s different is that as other investments have either gotten riskier or there’s a shortage of safe assets, farmland really holds the market position pretty well.”

“He sees farmland as a good investment and legacy asset,” said Jim Woodcock, the spokesperson. “He’s not a stranger in investing in Illinois, where he has spent a good portion of his life.”

Woodcock did not respond to questions about where else Khan, whose wealth has been estimated at $8 billion by Forbes Magazine, may be buying farmland.

A review of county property records identified about 8,400 acres of the Illinois purchases in 10 central Illinois counties. Baloo bought the parcels of land for about $84 million, according to a review by the Midwest Center for Investigative Reporting. Baloo, based in Urbana, made those purchases beginning in 2015, which is also when the company was created.

—

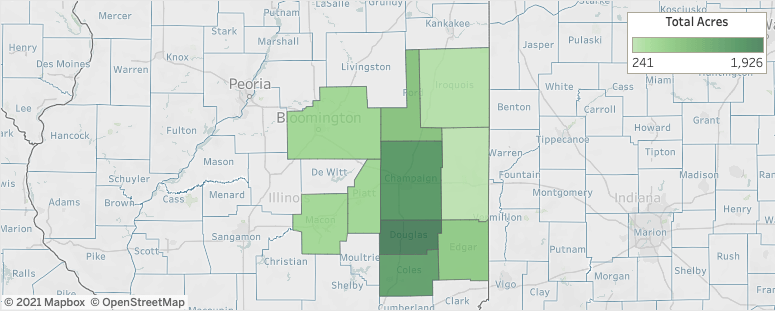

Total Acreage Purchased by Baloo Enterprises LLC in Central Illinois

A Midwest Center for Investigative Reporting review found Baloo Enterprises LLC, owned by Illinois billionaire Shahid Khan and based in Urbana, has purchased 8,427 acres of farmland in central Illinois.

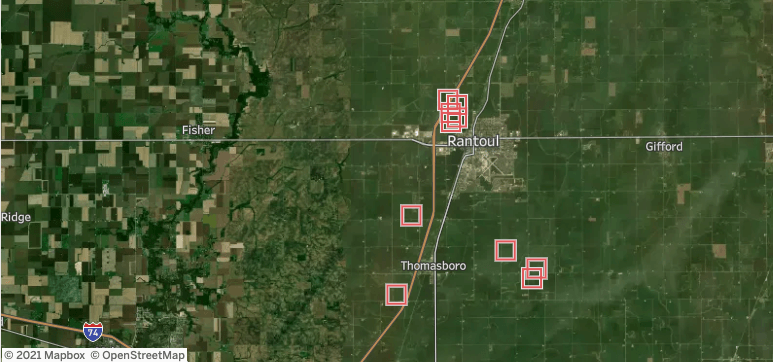

Satellite View of Farmland in Champaign County

Map based on approximate longitude and latitude from county GIS data and property record systems.

View the full interactive map here.

—

Purchases of farmland by wealthy individuals and hedge funds have surged in recent years, but it is not a new phenomenon, farm economic experts said. They said farmland has been a popular investment for a long time because of its stability.

The LandReport, a magazine that provides news and insight on America’s landowners, recently estimated that Microsoft founder Bill Gates is the largest farmland owner in the U.S., owning about 242,000 acres. Gates owns 17,940 acres in Illinois, the report also states.

In its review, the Midwest Center found that Baloo Enterprises LLC purchased:

- 1,926.3 acres of farmland in Douglas County for at least $19,694,096 between 2016 and 2019.

- 1,539.24 acres of farmland in Champaign County for at least $16,959,677 between 2015 and 2019.

- 1,402.28 acres of farmland in Coles County for at least $14,058,743 between 2015 and 2019.

Typically the land purchased by wealthy owners is rented out to farmers. A 2016 report by USDA showed that about 39% of farmland is rented. About 50% of farmland in Illinois is rented, according to the Illinois Society of Professional Farm Managers & Rural Appraisers.

Experts said farmland is an attractive investment due to its stability in returns. Todd Kuethe, an associate professor in farmland economics at Purdue, said that people who own farmland typically own it for a long period of time, so the value of the asset will appreciate over time and give a stable return.

Kuethe also said farmland is currently more stable than a lot of other markets.

“What’s different is that as other investments have either gotten riskier or there’s a shortage of safe assets, farmland really holds the market position pretty well,” Kuethe said. “So I think it’s sort of the attractiveness of farmland relative to other investments.”

Farm acreage at the northeast corner of 600E and 700N, Bement, Il belonging to Baloo Enterprises on Saturday, March 13, 2021.

Darrell Hoemann/CU-CitizenAccess

Bruce Sherrick, the director of TIAA Center for Farmland Research at the University of Illinois at Urbana-Champaign, said that the most common reason for selling farmland is to transfer the land after the owner passes away. He said that the heirs of the farmland receive the land at the current value, not the value it was originally purchased.

“I think a lot of farmers have an incentive to leave it in their estate until they pass away and then their heirs get it at a higher basis without paying capital gains,” Sherrick said.

This makes it difficult to acquire farmland, he said.

[Subscribe to our 2x-weekly newsletter and never miss a story.]

“It’s a very thin market,” Sherrick said. “That does explain a lot of the difficulty in acquiring farmland because there’s not much changes of hands year-to-year. It’s a very long-term, held-til-death asset in many cases.”

Kuethe said that the purchases of farmland by wealthy investors is a bit of a double-edged sword for farmers, as some have expressed concerns about it bidding up the price of buying land.

“It’s a very long-term, held-til-death asset in many cases.”

“At the same time, about half of farmland in the Midwest is rented,” Kuethe said. “And so, as long as they’re not able to acquire enough land that they can sort of influence what the prevailing cash rental rate is, farmers can still access that through rental markets.”

Sherrick also said that this isn’t much of a problem as farmers are about the same proportion of purchasers as any other year.

“I don’t think there’s anything especially notable about who buys farmland, if an institutional buyer buys it or a wealthy individual buys it or a neighboring farmer buys it,” Sherrick said. “It’s still going to be used the same way in the following year and the returns to that asset are not influenced much at all by who happens to own it at a point in time.”