Joe

While politics in Washington continues to be as fractious as ever, at least one issue seems to be able to bring political adversaries together: a desire to reform commodity checkoffs. On Tuesday, members of Congress proposed legislation that would limit the political and economic clout of these programs, which tax farmers to fund commodity-specific research and advertising. Meanwhile, a motley crew of ideologically diverse supporters, from the Heritage Foundation to the Humane Society, arrived in Washington to voice support.

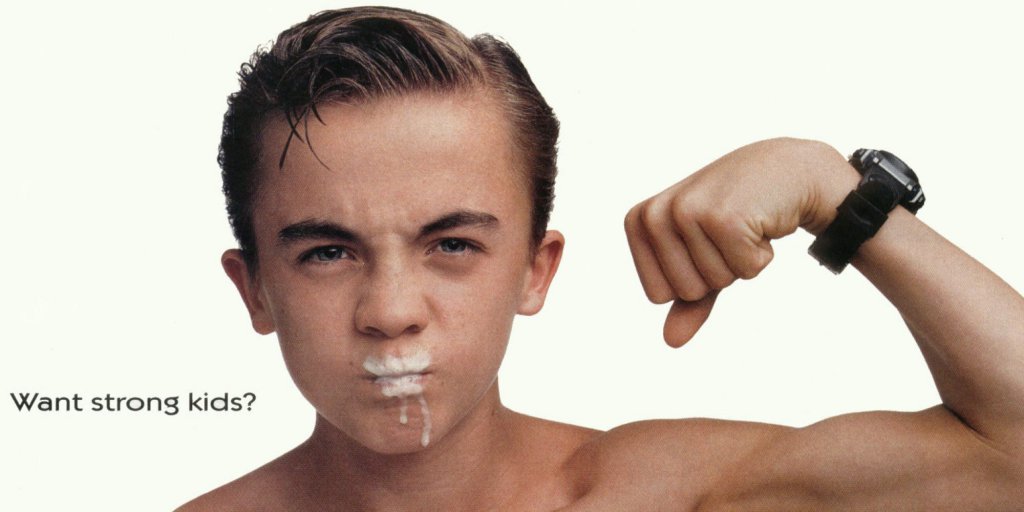

If you need some background on this topic, we’ve got you covered. See my recent piece on the proposed checkoff for the organic industry, which also explores how checkoffs work and why they’re so controversial. The basic gist is this: since checkoffs are incredibly powerful—they currently bring in a combined $500 million per year—it’s important that their funds are being used responsibly. There’s a sense among some farmers that, best case scenario, the money collected isn’t being spent in ways that serve them. Worst case? They feel the programs are brazenly corrupt.

Hence, legislation. Senators Cory Booker (D-NJ) and Mike Lee (R-UT) sponsored S. 741, the Opportunities for Fair Farming (OFF) Act; Reps. Dave Brat (R-VA) and Dina Titus (D-NV) put forward companion legislation in the House. The bill focuses on increasing transparency, addressing the long-standing complaint that checkoffs don’t do enough to let stakeholders follow the money. If passed, OFF would mandate the programs “make available for public inspection all budgets and disbursements of funds”—essentially, make all spending a matter of public record. According to the bill, record-keeping would necessarily include:

“(A) the amount of the disbursement;

(B) the purpose of the disbursement, including the activities to be funded by the disbursement;

(C) the identity of the recipient of the disbursement; and

(D) the identity of any other parties that may receive the disbursed funds, including any contracts or subcontractors of the recipient of the disbursement.”

The bill would also make it harder for checkoff money to be used for lobbying, a practice that’s not currently allowed but many seem to think happens routinely. OFF strengthens the prohibition by expressly forbidding checkoff board-members “to carry out checkoff program activities with a party that engages in activities for the purpose of influencing any government policy or action that relates to agriculture.”

These are changes that groups advocating for small farmers and ranchers, like the National Farmers Union and the Organization for Competitive Markets, have wanted for a long time. But the second bill introduced today, the Voluntary Checkoff Act—introduced by Senator Lee in the Senate and Rep. Brat in the House—would perhaps have even greater impact if enacted. It strikes at the very heart of checkoff programs by making them optional. The bill’s two simple statements—“No checkoff program shall be mandatory or compulsory,” and “producer participation in a checkoff program shall be voluntary at the point of sale”—would surely limit the scope of these programs. If farmers can opt out, participation will drop, which would decrease access to funds, and in turn would limit the political muscle of checkoff programs more generally.

It’s hard to say whether either bill will gain traction. The OFF act is similar to legislation Senators Lee and Booker proposed last year, which galvanized anti-checkoff factions but never went anywhere. Still, as partisan disputes become more and more acrimonious, checkoff reform stands out as a rare spot of common ground.