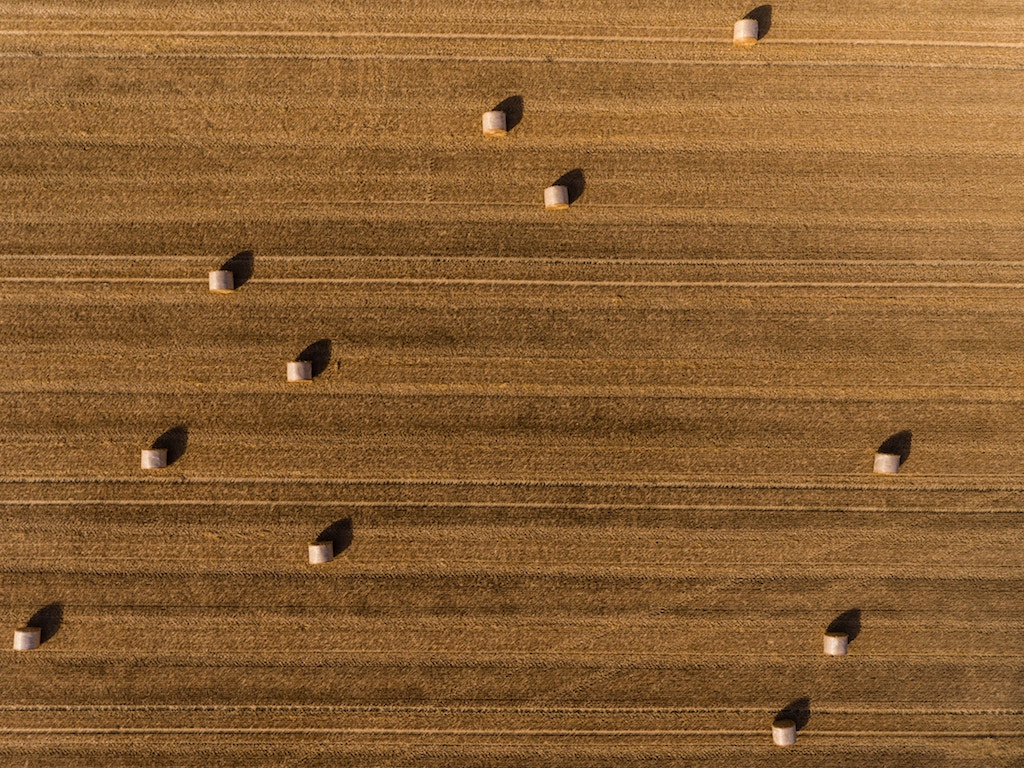

A new Iowa law will eliminate taxes for retired farmers selling or leasing their land

Beginning in 2023, retired farmers in Iowa will no longer have to pay state taxes when they lease or sell their farms, Iowa Capital Dispatch reports. That’s thanks to a new tax law passed by the state legislature last week, which eliminated taxes on most sources of retirement income for all residents. The legislation included two carveouts specific to the ag industry because some farmers treat their farms as a retirement plan, the way nonfarmers might treat a 401(k): Starting next year, farmers who sell their land and livestock can claim a tax exemption on their earnings, or they can lease out their land and claim an exemption on their rental income. Other fine print: Those who want to participate have to be at least 55 years old and have actively farmed for 10 years. The provisions are expected to cost the state more than $9 million in tax revenue in 2024. —Jessica Fu