Mario Tama/Getty Images

The Biden administration’s newly announced investment in small, independent processors is intended to level the playing field. But without addressing the root causes of market concentration, critics fear it may have limited impact.

The Biden-Harris Administration announced on Monday that it would dedicate $1 billion from the $1.9 trillion American Rescue Plan to curb consolidation and boost competition in the livestock industry, which it blames for rising prices at the grocery store.

The plan was well received by farm groups and some supporters of stronger antitrust laws, including organizations like the Farm Action and the Open Markets Institute. But it also received pushback from some of the very factions the move was intended to please. For cattle ranchers and anti-monopoly advocates who’ve long been concerned that a tiny handful of global food corporations control prices on both ends of the supply chain, the news represented a missed opportunity to address the root causes of industry concentration.

To understand these divergent responses, and why “consolidation”—a decades-long trend that narrowed the market to a small group of processing giants—has become a newly urgent flashpoint amid persistent supply chain frustrations, you need to know how the meat industry became so concentrated in the first place, and how the White House plan fits into that larger picture.

Big Meat: Big problem?

Beef prices have jumped an eye-popping 21 percent over the past year, according to the Department of Agriculture’s (USDA) latest food price outlook report; prices for pork increased by almost 17 percent and poultry by more than 8 percent in the same period. White House economic advisors last month estimated that meat is the single biggest contributor to rising food costs right now, accounting for a quarter of total price increases.

At the same time as meat’s gotten more expensive, cattle prices have gone down. In theory, that shouldn’t happen—and critics say the concentrated power of a small cohort of multinational meatpackers is to blame.

The Big Four are beautifully positioned to take advantage of supply chain chaos.

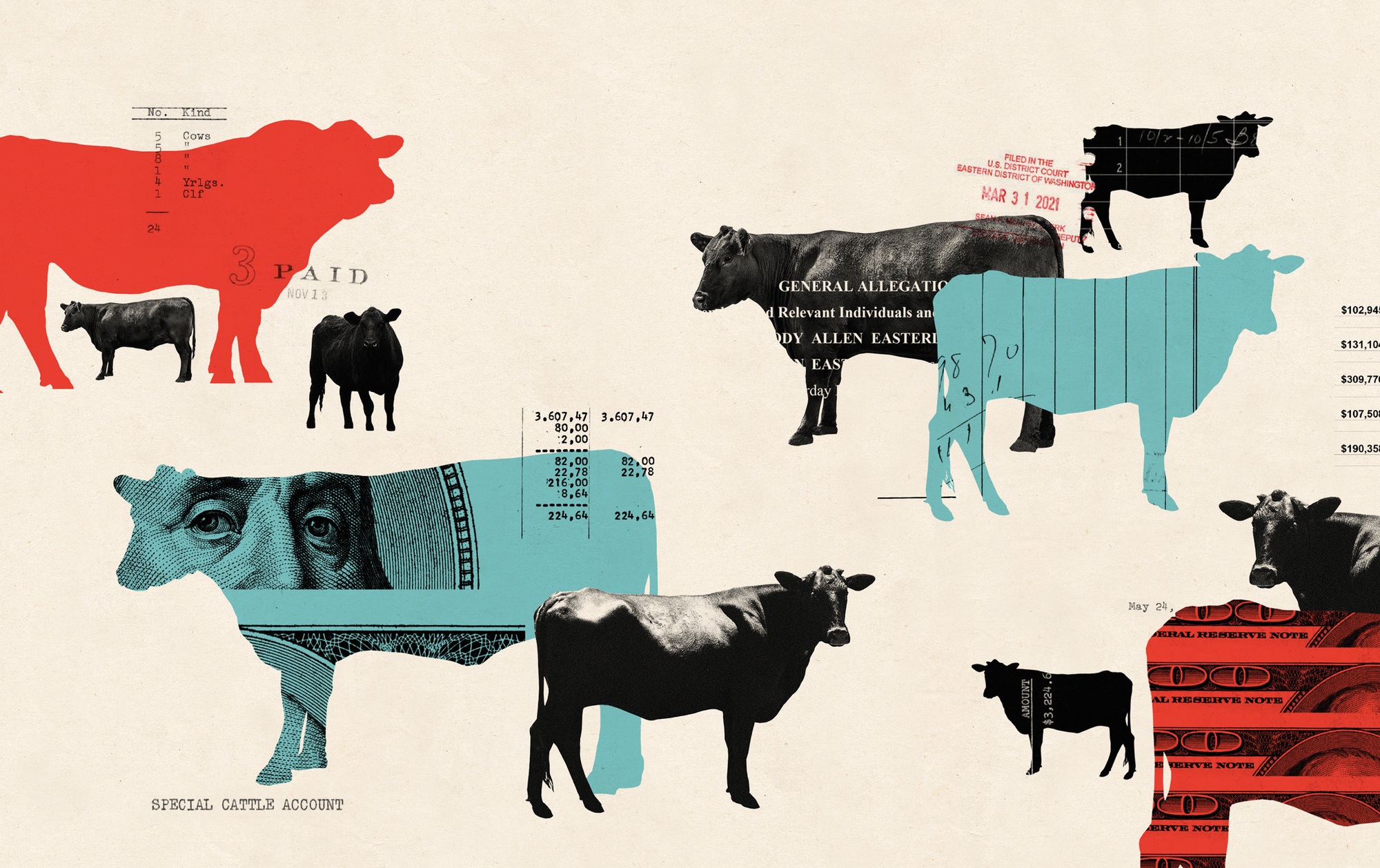

Today, the so-called “Big Four” beef processing companies—which include Tyson Foods, JBS, Cargill, and Marfrig—control around 85 percent of feedlot cattle in the U.S. (Beef has seen the fastest rate of consolidation compared to poultry and pork). In recent years, producers have accused these companies of engaging in anti-competitive business practices, like depressing live cattle prices through restrictive contracts or artificially restricted supply, while simultaneously reaping record profits.

The coronavirus pandemic has highlighted how this dynamic can play out under extreme circumstances: Outbreak-related shutdowns in the early spring of 2020 caused backlogs of live animals with nowhere to go for slaughter, tanking the prices big packers pay to ranchers for their animals. Meanwhile, on the other end of the supply chain, the resulting inventory shortages at grocery stores drove up the cost of meat for consumers. These concurrent trends meant that the “meat margin”—that is, the difference between what processors pay for livestock and what they charge for meat—widened significantly, leading to soaring profits.

In other words, the Big Four are beautifully positioned to take advantage of supply chain chaos: disruptions led to historically low cattle prices, but spooked consumers have proven willing to pay more to stockpile their freezers with meat.

How did we get the “Big Four?”

Economists measure consolidation using what is called the “four-firm concentration ratio,” which refers to the market share controlled by the four biggest companies in any given industry. In 1977, the four biggest beef packers controlled just 25 percent of the market, according to the U.S. Census Bureau. Within 15 years, that number had jumped to 71 percent—a nearly threefold increase. Today, that number hovers around 85 percent.

James MacDonald, a University of Maryland agricultural economics professor who has conducted research on meat industry concentration, said that two important factors drove what he described as a “dramatic” rate of consolidation in the industry in the 1970s and 1980s: economies of scale and lower wages.

“In beef packing, an important driver was that large firms realized they could reduce processing costs by building much bigger plants,” he said. Another key factor was a series of labor fights that resulted in lower wages for the meatpacking workers employed by those companies that were rapidly expanding, further accelerating their dominance within a consolidating industry.

“In beef packing, an important driver was that large firms realized they could reduce processing costs by building much bigger plants.”

“Through the early 1980s, there was a series of labor battles, strikes, lockouts, plant closures,” MacDonald said. “In a very short period of time, the average production worker wage in meatpacking fell very sharply, [particularly] in the larger plants, because that’s really where they broke the unions.” Average hourly wages in the largest meatpacking plants fell by almost 15 percent in the decade between 1982 and 1992.

Together, MacDonald said, those factors helped the biggest packers to become very large and cost-efficient, while making it harder for smaller packers to compete—setting the stage for the concentrated industry we see today.

What would the White House plan do to curb consolidation?

A lot—at least according to the White House. Its billion-dollar aid package will include $375 million in grants for independent processing plants (which it expects to pay out through the spring and summer of this year); $375 million in loan support; $100 million to fund worker safety and training programs; $50 million in research and development, and $100 million in subsidies to help small processing plants cover inspection costs.

But critics of the plan argue that the White House largely excluded from its announcement a concrete timeline by which it would enforce the robust competition laws that already exist.

In 1921, Congress passed the Packers and Stockyards Act, a set of laws aimed at protecting producers from anti-competitive practices on the part of meatpackers, like unequal treatment and price manipulation. In 2016, the Obama administration promulgated a set of rules under the act that would have given farmers and ranchers an avenue for legal recourse against those unfair practices, and outlawed delayed payment and economic retaliation, among other things. Those reforms were later rolled back under the Trump administration. In June of last year, USDA announced that it had begun working to reinstate them and to strengthen its enforcement actions under the Packers and Stockyards Act. That hasn’t yet happened, though—and now, six months later, supporters of these protections are scratching their heads, wondering when the agency will actually take action.

“USDA is going to essentially establish a hotline so cattle producers could continue complaining about potentially anti-competitive practices to a regulatory agency that hasn’t done anything about all of the previous complaints that have been filed.”

Monday’s announcement provided little clarity. Instead, USDA committed that it would, within 30 days, set up a tip line through which farmers and ranchers could file complaints about unfair practices. The agency would then refer them to the Department of Justice for investigation “as appropriate”—a far cry from the decisive steps that anti-monopoly advocates were hoping for.

“They’re going to essentially establish a hotline so cattle producers could continue complaining about potentially anti-competitive practices to a regulatory agency that hasn’t done anything about all of the previous complaints that have been filed,” said Bill Bullard, president and CEO of Ranchers-Cattlemen Action Legal Fund United Stockgrowers of America (R-CALF USA). In 2019, R-CALF USA filed a lawsuit against the Big Four, alleging anti-competitive business practices. An amended version of the case is currently in discovery.

Who’s getting excited?

Owners of independent meat processing plants, obviously, as well as many livestock producers. In July, USDA received more than 400 comments from industry stakeholders, including farmers, ranchers, and processing companies, many of them largely enthusiastic about federal funding to expand meat processing capacity, worker training, and infrastructure investments.

Monday’s announcement was also warmly received by multiple lawmakers and organizations, including those that have advocated for greater scrutiny of meatpacking giants.

“We must get to the bottom of why farmers and ranchers continue to receive low payments while families across America endure rising meat prices.”

“For too long, our meat and poultry supply chain has been over reliant on a handful of large-scale companies that dominate the market,” wrote Representative Chellie Pingree, the Democratic congresswoman from Maine, in a press release. (Pingree has previously sponsored legislation that would provide funding for small processors.) “The Biden-Harris Administration’s action plan […] will work to create a more competitive and resilient meat and poultry sector and is a win for local farmers and small businesses, the market, consumers, and hungry Americans.”

Bigger groups like the Farm Bureau also welcomed the announcement.

“American Farm Bureau Federation appreciates the Biden administration’s continued work to ensure a fair and competitive meat processing system,” read a statement from president Zippy Duvall. “We must get to the bottom of why farmers and ranchers continue to receive low payments while families across America endure rising meat prices.”

Who’s not having it?

Those who believe that an influx of funding can’t fix a system rigged against small- and mid-scale processors. From an economic standpoint, said Darren Hudson, a professor of agricultural economics at Texas Tech University, who has researched concentration in agriculture, a $1 billion investment is unlikely to effect any significant, long-term change in the meat supply chain.

“It’s a horrible idea,” he said. “Subsidizing small processors isn’t going to solve any real problems. In a short run it might prop up or encourage some small processors to engage in meat processing [….] But unless they’re operating at a cost that’s equivalent to or very near what the major processors are, they won’t be able to compete over the long run.”

What’s an alternative?

Hudson’s sentiment was echoed by Austin Frerick, deputy director of the antitrust-oriented Thurman Arnold Project at Yale University, who called the plan “naive.” Going a step further, Frerick said that focusing resources solely on supporting small processors, instead of scrutinizing the practices of packing giants, meant USDA was missing the forest for the trees.

“They understand the issue, they want to pretend to have a solution, but they don’t want to actually do anything meaningful here or they don’t want to actually grapple with this industry, grapple with this corporate power that’s run amok,” he said.

Short of addressing the root causes of market concentration, any independent processors subsidized by federal dollars would still face the same economic challenges that pushed their predecessors out of business in the first place.

Like Bullard, Frerick said it would be far more effective to just enforce the Packers and Stockyards Act. Short of addressing the root causes of market concentration, any independent processors subsidized by federal dollars would still face the same economic challenges that pushed their predecessors out of business in the first place.

Since the 1980s, the meatpacking industry has undergone a series of mergers, in which larger packers edged out or bought up smaller competitors, usually those on the financial brink due to downward economic pressure that the bigger processors could exert. Frerick said he wouldn’t be surprised to see another wave of similar acquisitions between the Big Four and their smaller, subsidized competitors when the federal funding dries up.

“They’re throwing all this money at these plants,” Frerick said. “I just expect that in a few years they’ll go broke and then the big companies will buy them for pennies on the dollar.”